Legislation concerning pearls in French Polynesia

Country Law No. 2017-16 of 18 July 2017

Relating to the exercise of professional activities connected with pearl culture in French Polynesia

The full content of the law is structured by titles, chapters, sections and articles as published in the Official Journal of French Polynesia.

This document notably includes:

Official text published in the Official Journal of French Polynesia on 18 July 2017.

COUNTRY LAW No. 2017-16 of 18 July 2017 regulating professional activities linked to the production and marketing of pearl and mother-of-pearl products in French Polynesia.

NOR: DRM1621306LP

After the opinion of the Economic, Social and Cultural Council of French Polynesia;

The Assembly of French Polynesia has adopted;

Having regard to the decision of the Council of State No. 407125 dated 28 June 2017;

The President of French Polynesia hereby promulgates the following Country Law:

TITLE I — PURPOSE

Article LP.1 — The purpose of this Country Law is to regulate the activities of nucleus dealers, producers of pearl oysters, producers, traders, jeweller-retailers, artisan-retailers and duty-free enterprises dealing in pearl products originating from the pearl oysters present in French Polynesia — notably Pinctada margaritifera var. cumingii and Pinctada maculata — as well as products of mother-of-pearl.

It lays down rules relating to the production, classification, transport, marketing and export of raw and worked pearl products, jewellery and articles containing them, as well as mother-of-pearl products of French Polynesia.

TITLE II — DEFINITIONS

Chapter I — Pearl products and mother-of-pearl products of French Polynesia

Section I — Pearl and mother-of-pearl products from the pearl oyster <em>Pinctada margaritifera</em> var. <em>cumingii</em>

Sub-section 1 — The natural (fine) Tahitian pearl

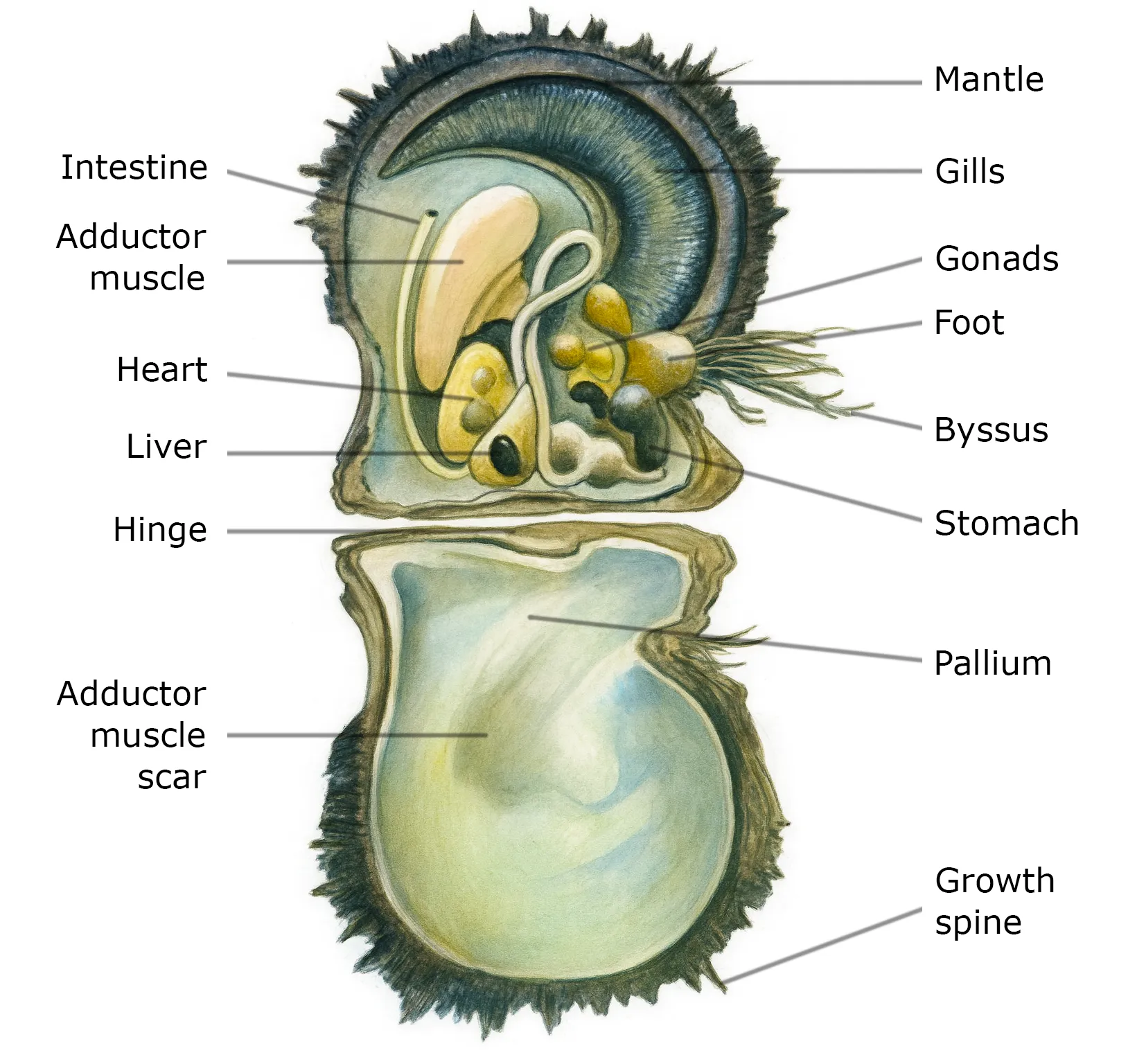

Art. LP.2 — The natural (fine) Tahitian pearl is a natural concretion secreted accidentally, without any human intervention, inside the pearl oyster Pinctada margaritifera var. cumingii present in French Polynesia. It is composed of concentric layers of nacre tablets deposited one upon another — a material formed of calcium carbonate (aragonite) associated with organic compounds — laid in thin layers separated by organic membranes.

Sub-section 2 — Cultured pearls

Paragraph I — The cultured Tahitian pearl

Art. LP.3 — The cultured Tahitian pearl is a pearl of natural colour, resulting from grafting and rearing in a natural environment in French Polynesia, and having undergone none of the treatments defined in Article LP.10 of this Country Law.

It is the raw product of the biomineralisation process of epithelial cells of a graft — a piece of mantle taken from a donor mollusc of the genus Pinctada, originating from French Polynesia — around a nucleus. This support, with specific characteristics, is inserted by humans into the pearl pocket (gonad) of the pearl oyster Pinctada margaritifera var. cumingii. It enables the graft to develop a pearl sac at the origin of the biomineralisation of the nacre layer.

The cultured Tahitian pearl is composed of numerous concentric nacre layers deposited one over another around the nucleus. These nacre layers, whose composition is substantially identical to that of the mother-of-pearl shell, are composed of conchiolin (around 6%) and aragonite crystals (around 92%), the remainder being various mineral salts and water.

An order adopted by the Council of Ministers defines the characteristics of the nuclei authorised for the production of cultured Tahitian pearls.

Paragraph II — Other cultured pearls

Art. LP.4 — Other cultured pearls are pearls that follow the biomineralisation process and composition defined in Article LP.3 of this Country Law, but which use a nucleus whose composition and/or shape differs from that authorised for the production of cultured Tahitian pearls, or a graft whose origin is other than a mollusc of the genus Pinctada.

Paragraph III — Tahitian keshi

Art. LP.5 — Tahitian keshi is a cultured pearl without a nucleus, of natural colour, formed entirely of nacre layers resulting from the biomineralisation process of the pearl sac formed from the epithelial cells of the graft — a piece of mantle taken from a donor mollusc originating from French Polynesia.

After human intervention, this graft is either introduced on its own into a recipient oyster of the species Pinctada margaritifera var. cumingii reared in French Polynesia, or introduced together with a nucleus which is subsequently expelled from the pearl pocket (gonad) or becomes separated from the graft following movement within the recipient oyster’s pearl pocket.

Paragraph IV — The Tahitian blister cultured pearl

Art. LP.6 — The Tahitian blister cultured pearl, commonly called a mabe, is the product made in French Polynesia resulting from:

— nacre secretion around a half-bead glued to the inner surface of the shell of a pearl oyster Pinctada margaritifera var. cumingii;

— and a manufacturing process comprising four successive stages:

- cutting the mother-of-pearl shell;

- removing the half-bead;

- filling with resin;

- permanently closing the concavity with a piece of polished Tahitian mother-of-pearl shell, or mounting as a finished item or jewellery article;

The second and third indents are optional.

The nacre deposits covering this half-bead have a lamellar arrangement identical to that of the deposits in the Tahitian mother-of-pearl shell defined in Article LP.7 of this Country Law.

Sub-section 3 — The Tahitian mother-of-pearl shell

Art. LP.7 — The Tahitian mother-of-pearl shell is the natural product of nacre secretion by the pearl oyster Pinctada margaritifera var. cumingii present in French Polynesia.

These nacre secretions, deposited in lamellar form, are subdivided into three layers:

- an outer organic layer, the periostracum, composed of conchiolin;

- an intermediate prismatic layer, the ostracum, composed essentially of calcite;

- an inner nacreous layer corresponding to tabular aragonite deposits.

Section II — Pearl and mother-of-pearl products from the pearl oyster <em>Pinctada maculata</em>

Sub-section 1 — The golden natural (fine) Tahitian pearl

Art. LP.8 — The golden natural (fine) Tahitian pearl, commonly called “poe pipi”, is a natural concretion secreted accidentally, without any human intervention, inside the pearl oyster Pinctada maculata present in French Polynesia. It is composed of concentric layers of nacre tablets deposited one upon another, formed essentially of calcium carbonate (aragonite) associated with organic compounds.

Sub-section 2 — The golden natural blister pearl of Tahiti

Art. LP.9 — A golden natural blister pearl of Tahiti is an excrescence accidentally secreted, without any human intervention, on the inner wall of the shell of the pearl oyster Pinctada maculata present in French Polynesia. This natural concretion is composed of concentric layers of nacre tablets deposited one upon another, formed essentially of calcium carbonate (aragonite) associated with organic compounds.

Section III — “Treated” natural and cultured pearls

Art. LP.10 — Natural pearls and cultured pearls produced in French Polynesia must be accompanied by the mention “treated” or by an indication of the treatment:

- when they have undergone artificial bleaching;

- when they have been treated by the deposition of any coating on the surface that irreversibly modifies their external appearance;

- when they have undergone “peeling”, a technique that removes nacre layers;

- when, as the case may be, they have undergone treatment by irradiation, laser, dye, surface diffusion, filling — possibly as a residue of heat treatment — of foreign colourless substances solidified in exterior cavities showing breaks in reflection visible under a 10× loupe, or by any other method modifying their appearance, colour or purity.

Chapter II — Definitions arising from the activity of pearl-oyster producers and producers of pearl products

Section I — Artificial fertilisation and spat collection

Sub-section 1 — Artificial fertilisation

Art. LP.11 — Artificial fertilisation is an operation consisting in producing planktonic larvae of the pearl oyster Pinctada margaritifera var. cumingii in a controlled environment. This operation is carried out in a hatchery and must comply with the regulations in force.

Sub-section 2 — Spat collection

Art. LP.12 — Spat collection is an operation consisting in promoting the settlement of planktonic larvae of the pearl oyster Pinctada margaritifera var. cumingii on supports artificially placed for this purpose. The “collector” is the support on which the larvae may settle.

Section II — Rearing and transfer

Sub-section 1 — The collection station

Art. LP.13 — A collection station is a set of collectors fixed on a mainline moored at a chosen location.

Sub-section 2 — Rearing Pinctada margaritifera var. cumingii pearl oysters

Art. LP.14 — The rearing of Pinctada margaritifera var. cumingii pearl oysters is an operation necessary for their development. It is accompanied by the care, maintenance and selections required for grafting.

Sub-section 3 — Rearing grafted Pinctada margaritifera var. cumingii pearl oysters

Art. LP.15 — The rearing of grafted Pinctada margaritifera var. cumingii pearl oysters is an operation necessary for their development, maintenance and the production of cultured Tahitian pearls.

Sub-section 4 — Transfer of Pinctada margaritifera var. cumingii pearl oysters

Art. LP.16 — The transfer of Pinctada margaritifera var. cumingii pearl oysters is an operation consisting in moving oysters from their place of production to another site for rearing or grafting. Inter-island transfers of pearl oysters must comply with the conditions laid down by the regulations in force.

Section III — Grafting, harvest and regrafting

Sub-section 1 — Grafting the pearl oyster Pinctada margaritifera var. cumingii

Art. LP.17 — Grafting the pearl oyster Pinctada margaritifera var. cumingii is the operation consisting in incising the tissues located above the pearl pocket and introducing the graft and the nucleus into the oyster’s pocket.

Sub-section 2 — Harvesting cultured Tahitian pearls

Art. LP.18 — Harvesting cultured Tahitian pearls is the operation consisting in extracting the pearls from the pearl pocket.

Sub-section 3 — Regrafting the pearl oyster Pinctada margaritifera var. cumingii

Art. LP.19 — Regrafting the pearl oyster Pinctada margaritifera var. cumingii is the operation consisting in introducing a new nucleus into the pearl sac after the extraction of the cultured pearl resulting from the first graft or a previous regraft.

TITLE III — CLASSIFICATION OF THE CULTURED TAHITIAN PEARL

Art. LP.20 — Every cultured Tahitian pearl is subject to classification criteria called general or additional criteria.

Chapter I — General criteria

Art. LP.21 — The general criteria are the size, weight, shape and surface quality of the pearl. These criteria are defined by an order adopted by the Council of Ministers.

Chapter II — Additional criteria

Art. LP.22 — The additional classification criteria include in particular colour, assortment, matching and the nacre thickness around the nucleus. These criteria are defined by an order adopted by the Council of Ministers.

TITLE IV — ACTIVITY OF NUCLEUS DEALER AND THE IMPORT OF NUCLEI

Chapter I — Activity of nucleus dealer

Section I — Definition of the nucleus dealer, eligibility, disabilities and incompatibilities

Sub-section 1 — Definition

Art. LP.23 — A nucleus dealer is any natural or legal person who manufactures, purchases, recycles or imports nuclei with a view to selling them.

They may sell nuclei only to a producer of pearl products holding a valid card, or to another nucleus dealer holding a valid card.

Sub-section 2 — Eligibility

Art. LP.24 — Eligible for authorisation to exercise the activity of nucleus dealer is any natural person who is a European national or any legal person having their domicile or registered office in French Polynesia.

Sub-section 3 — Disabilities

Art. LP.25 — No one may engage in or lend their assistance, even incidentally, to the operations referred to in Article LP.23 of this Country Law if they have been convicted of a criminal offence or of any of the offences listed below:

- forgery and use of forgeries in private commercial or banking instruments, forgeries defined in Chapter I, Title IV (Art. 441 et seq.) of the Penal Code;

- theft, receiving stolen goods, fraud, breach of trust, bankruptcy, extortion of funds, value or signature, offences punishable under the Penal Code;

- issuing cheques without funds and offences relating to usury, money-lending and certain canvassing and advertising operations;

- misappropriations committed by public depositaries, extortion by public officials, corruption of public officials and employees of private companies;

- perjury, false oaths and subornation of witnesses;

- offences provided for in Article 13 of Law No. 52-332 of 24 March 1952 relating to deferred credit companies.

Sub-section 4 — Prohibition on exercising

Art. LP.26 — The same prohibition on exercising the activity of nucleus dealer is incurred:

- by persons subject to personal bankruptcy or to any of the disqualification measures provided for by the provisions of the Commercial Code;

- by dismissed ministerial officers;

- by court-appointed administrators and receivers who have been removed;

- by members who have been disciplinarily and definitively struck off for breaches of probity from professions organised as an order.

Sub-section 5 — Incompatibility

Art. LP.27 — Any natural or legal person authorised to exercise the activity of nucleus dealer may not exercise the activity of pearl-oyster producer and producer of pearl products under the same legal entity.

Section II — Authorisation scheme for exercising the activity of nucleus dealer

Art. LP.28 — Any natural or legal person wishing to exercise the activity of nucleus dealer must first submit an application for authorisation to the department responsible for pearl culture. This authorisation takes the form of a nucleus dealer’s card.

The applicant must meet the following conditions:

A — Provide proof of premises for the storage and sale of nuclei in French Polynesia;

B — Provide proof of a regular tax situation with respect to the department in charge of taxes and public contributions;

C — Provide proof of a regular situation with the Social Security Fund;

D — Have taken out, with a company having a permanent establishment in French Polynesia, insurance covering the risks of professional civil liability incurred as a result of their act, fault or negligence, or that of their officers, agents, employees or volunteers;

E — Not be subject to any of the disabilities, prohibitions on exercising or incompatibilities defined in Articles LP.25, LP.26 and LP.27 of this Country Law. In order to verify that the applicant is not affected by these disabilities and prohibitions, the department in charge of pearl culture shall request bulletin No. 2 of the applicant’s criminal record from the competent authority.

These conditions are required for a legal person, with the exception of point E) of this Article, which shall be provided by the natural persons who have decision-making power.

As part of the examination of the application, the department in charge of pearl culture is empowered to carry out any useful investigations and to request from the applicant and the competent administrations any additional information or documents deemed necessary.

The nucleus dealer’s card is valid for five years but may be withdrawn at any time if the conditions under which it was issued are no longer met. It is renewable as long as the conditions that prevailed at the time of issue are still met.

For any renewal, the applicant must first be up to date with their reporting obligations, and the renewal application must be filed within three months before its expiry. On expiry of the authorisation, the holder loses the benefit of the card and must submit a new application.

The nucleus dealer’s card is personal and non-transferable and, in the case of a legal person, is issued to the legal representative, in that capacity.

In the event of death or change of legal representative, the legal person has a period of two months to file a complete file in the name of the new representative with the department in charge of pearl culture.

During this period and the time taken to process the file, the legal person may continue to carry on its activity.

An order adopted by the Council of Ministers lays down the procedures for examining the application for authorisation to exercise the activity of nucleus dealer and the conditions for granting, renewing and withdrawing it.

Section III — Reporting obligations

Art. LP.29 — The nucleus dealer must keep up to date a register of purchases and sales of nuclei which must be available for consultation at any time on the dealer’s premises. The nucleus dealer is required to periodically provide the department in charge of pearl culture with the data necessary to monitor production quotas. The content of the register, the data necessary for monitoring production quotas and their submission procedures are defined by an order adopted by the Council of Ministers.

The department in charge of pearl culture may carry out inspections of the stocks of nuclei held by nucleus dealers and of the documents supporting the information declared.

Chapter II — Import of nuclei

Section I — Scope and conditions of application

Art. LP.30 — Only holders of a valid nucleus dealer’s card or a producer of pearl products’ card and the department in charge of pearl culture may import nuclei.

Each operation to import nuclei must be accompanied by the production of an import licence issued by the authority managing import licences after advice from the department in charge of pearl culture.

The department in charge of pearl culture gives its opinion on the application to import nuclei for health or environmental reasons depending on their composition, and notably the nature of any coatings or additives.

An order adopted by the Council of Ministers defines the conditions and the authorisation scheme and grounds for refusal for the import licence for nuclei.

Section II — Derogations

Art. LP.31 — Producers of pearl products importing nuclei for their own account and the department in charge of pearl culture are not required to obtain a nucleus dealer’s card.

TITLE V — PRODUCERS OF PEARL OYSTERS AND PRODUCERS OF PEARL PRODUCTS

Chapter I — The producer of pearl oysters and the producer of pearl products

Section I — Definition of the producer of pearl oysters and the producer of pearl products; eligibility; incompatibility

Sub-section 1 — Definition of the activity of producer of pearl oysters and of producer of pearl products

Art. LP.32 — A producer of pearl oysters is any natural or legal person who carries out the operations required for the rearing of pearl oysters — including transport, maintenance, selection, grafting and regrafting — and who may sell and export mother-of-pearl shells. They may not sell or export pearl products.

A producer of pearl products is any natural or legal person who carries out grafting, harvest and regrafting and prepares, transforms and markets the raw or worked products resulting from their own production.

An order adopted by the Council of Ministers sets the detailed list of activities performed under each status and the conditions under which they are carried out. [The uploaded source contains ellipses at several points; the sense above follows the original headings.]

Sub-section 2 — Derogation

Art. LP.33 — Each producer may use service providers for all or part of the operations of transport, maintenance, selection, grafting and regrafting of pearl oysters.

Sub-section 3 — Eligibility

Art. LP.34 — Eligible for authorisation to exercise the activity of producer of pearl oysters or producer of pearl products is any natural person who is a European national, or any legal person having their domicile or registered office in French Polynesia.

Sub-section 4 — Incompatibility

Art. LP.35 — Any natural or legal person authorised to exercise one of the activities may not exercise the other under the same legal entity. [text condensed from the source]

Section II — Authorisation scheme to exercise the activity of producers of pearl oysters and producers of pearl products

Art. LP.36 — Any natural or legal person wishing to exercise the activity of producer of pearl oysters and/or producer of pearl products must first apply to the department responsible for pearl culture for the relevant authorisation(s) — a producer of pearl oysters’ card and/or a producer of pearl products’ card.

The applicant must meet the following conditions:

A — Be up to date with their tax obligations with the department responsible for taxes and public contributions;

B — Be up to date with their obligations to the Social Security Fund;

C — Provide a title deed or a lease, or failing that the written authorisation of the owners of the lands located near the requested sites;

D — Demonstrate professional aptitude based on training, or show that they have successfully completed the training provided by the Centre des métiers de la perliculture (Pearl-farming Vocational Centre) or equivalent. [parts of the source are truncated with “...”]

Section III — Temporary occupation authorisation of the public maritime domain for pearl-farming purposes

Art. LP.37 — The temporary occupation authorisation (AOT) of the public maritime domain is a prerequisite for operating a pearl-farming site. The occupation of the public domain without title is punishable in accordance with the rules governing the management and administration of the public domain in French Polynesia. [source condensed]

Sub-section 1 — Grant and refusal of the authorisation

Art. LP.38 — The AOT specifies the location and area of the site, the authorised installations and equipment, the amount of the annual fee and its payment terms. The grant or refusal of the AOT is subject to the following rules:

A — Respect for the ecological cap: the ecological cap is the maximum surface area and/or number of rearing stations that can be installed within the same lagoon. It takes into account the size of the lagoon, its carrying capacity and the cumulative loads already authorised. Where the ecological cap is exceeded, no new surface or station may be authorised; [rest of article abbreviated where the uploaded file shows “...”]

Sub-section 2 — Conditions for using the public maritime domain for pearl-farming purposes

Art. LP.39 — The terms of use of the occupied area (maintenance of installations, marking, safety, environmental protection, waste management, etc.) are defined by order of the Council of Ministers. [The detailed points are truncated in the source file.]

Sub-section 3 — Renewal of the authorisation

Art. LP.40 — Renewal is subject to compliance with the applicable rules and to the payment of fees; the renewal procedure and time limits are laid down by order. [source truncated]

Sub-section 4 — Change of location

Art. LP.41 — A change of location may be authorised subject to technical and environmental feasibility and availability within the lagoon’s ecological cap. [source truncated]

Sub-section 5 — Change of area

Art. LP.42 — A holder who wishes to reduce their operation on the public maritime domain lodges a simple, reasoned request with the department in charge of pearl culture. A holder who wishes to extend their operation files a request with the same department together with the plans of the project and proof of fee payments. An order of the Council of Ministers lays down the instruction procedure for a request to change surface area.

Sub-section 6 — Non-transferability, sub-leasing and transfer

Art. LP.43 — The AOT is non-transferable and may not be sub-leased. Any unauthorised transfer or sub-lease may lead to revocation of the authorisation by the Council of Ministers. By way of derogation, transfers are permitted in the limited cases listed below, including in particular: (i) transfer from a natural person to a newly created company in which they hold a majority; (ii) transfer between legal persons within the same group under conditions defined by regulation. [wording condensed from the source]

Sub-section 7 — Death of the holder of a temporary occupation authorisation

Art. LP.44 — In the event of the death of a holder, the AOT may, on request within the prescribed time limit, be provisionally maintained for the benefit of the heirs, pending transfer to an eligible person and issue of an authorisation to exercise the activity of producer of pearl products to the new holder. [source truncated]

Sub-section 8 — Reduction of surface area

Art. LP.45 — The administration may reduce the authorised surface area in the cases and under the conditions provided by regulation, in particular for environmental reasons or in the event of non-use of part of the area. [source truncated]

Sub-section 9 — Withdrawal

Art. LP.46 — Where the authorisation to exercise the activity of producer of pearl products is withdrawn, the AOT for pearl-farming purposes is revoked. Withdrawal of the AOT under these conditions does not give rise to compensation.

Sub-section 10 — Fate of installations and productions upon cessation of authorisations

Art. LP.47 — Upon cessation, for whatever reason, of the AOT, the installations and productions are treated in accordance with the time limits and methods defined by order of the Council of Ministers; the restoration of the public maritime domain is carried out under the conditions set by regulation and within the maximum period laid down by order.

Section IV — Hatcheries for pearl oysters <em>Pinctada margaritifera</em> var. <em>cumingii</em>

Sub-section 1 — Definition

Art. LP.48 — A pearl‑oyster hatchery is a set of land and marine facilities and techniques intended for the reproduction of Pinctada margaritifera var. cumingii and the production, settlement and rearing of larvae in a controlled environment.

Sub-section 2 — Authorisation scheme

Art. LP.49 — Any producer of pearl oysters operating a hatchery must obtain authorisation in the form of a pearl‑oyster hatchery producer card.

The applicant must meet the following conditions:

A — Provide a project describing the intended use of the hatchery’s oysters (donor oysters for grafts, oysters intended for grafting, or exclusive in‑house use), the intended commercial or non‑commercial nature of the production, and the planned infrastructure and equipment;

B — Provide proof of ownership or a lease for the location of the facilities;

C — Demonstrate competence in oyster reproduction and larval rearing in a hatchery, or employ competent personnel.

The application is examined by the department in charge of pearl culture, which may request any useful investigation, additional information or documents, particularly in light of sanitary, genetic or economic considerations in the sector.

The authorisation entitles the holder to market hatchery‑produced pearl oysters. It may be restricted to one or more purposes as follows:

— production of donor oysters (for graft tissue);

— production of oysters intended for grafting;

— exclusive use by a holder of an authorisation to exercise the activity of producer of pearl oysters and/or producer of pearl products.

The authorisation may also be limited to a quantity of oysters to be produced within a given period.

The validity of the hatchery authorisation is tied to, and ends with, the validity of the authorisation to exercise the activity of producer of pearl oysters.

An order adopted by the Council of Ministers lays down the application procedures for this Article.

Section V — Reporting obligations

Art. LP.50 — Every producer of pearl oysters must keep an up‑to‑date register available at all times on the farm for inspection by the department in charge of pearl culture.

Any producer operating a pearl‑oyster hatchery must also maintain dedicated registers (broodstock origin and batches, fertilisation and larval‑rearing operations, and any use of medicinal products) and transmit the required data to the department at the minimum frequency prescribed. [Partly truncated in the uploaded source.]

Section VI — Inter‑island transfers

Art. LP.51 — Inter‑island transfer of pearl oysters requires prior authorisation. The application, its supporting documents and the decision deadlines are set by order of the Council of Ministers. Authorisation specifies the quantities, origin and destination, and any sanitary requirements. A transfer not carried out within the authorised period requires a new authorisation. [Partly truncated in the uploaded source.]

Section VII — Import and export

Art. LP.52 — The import and the export outside French Polynesia of live oysters of the genus Pinctada are prohibited.

The prohibition may be lifted, on a case‑by‑case basis, by decision of the Council of Ministers after advice from the department in charge of pearl culture, for scientific research programmes.

An order adopted by the Council of Ministers sets the conditions for granting an import authorisation for scientific programmes.

TITLE VI — POWER OF ATTORNEY

Art. LP.53 — For inter‑island transport of live pearl oysters, the presence of the holder or of a duly appointed proxy is required; failing this, the transport is irregular.

For post‑production controls and pre‑export controls, a card‑holder may grant power of attorney to a designated natural person.

For pre‑export controls, and for the purchase and sale operations carried out by professionals, a card‑holder may likewise grant power of attorney to a designated natural person. The number of powers of attorney that a professional card‑holder or an approved entity may grant is limited.

The department in charge of pearl culture issues an identification card to each authorised proxy; the proxy acts under the holder’s responsibility. [Partly truncated in the uploaded source.]

TITLE VII — PRODUCTION OF PEARLS FROM THE PEARL OYSTER <em>Pinctada margaritifera</em> var. <em>cumingii</em>

Chapter I — Global and individual production quotas

Art. LP.54 — The global production quota and the individual production quotas are established for pearl‑farming purposes in French Polynesia.

These production quotas are set at least one year before they take effect and are subject to the penalties referred to in Articles LP.97 and LP.98 of this Country Law.

By way of derogation during the year following the promulgation of this Country Law, the global production quota may be set under special transitional conditions. [Partly truncated in the uploaded source.]

Art. LP.55 — The global production quota is the maximum number of grafts that may be performed in a given year for pearl‑farming purposes in French Polynesia.

It is determined on the basis of, in particular:

— the ecosystem’s characteristics;

— spat‑collection conditions;

— authorised maritime surface area;

— economic data;

— any other relevant scientific or technical elements. [Partly truncated in the uploaded source.]

Art. LP.56 — The individual production quota is the number of grafts that a producer of pearl products is authorised to carry out within a given lagoon during a calendar year.

The individual production quota is personal and non‑transferable, except in the cases and conditions set by regulation. It is allocated by the administration, taking into account, in particular: the lagoon’s general health; the lagoon‑occupation rate; compliance with applicable regulations; job creation or retention; and the quality of past production.

The calculation methods for individual quotas and the transfer terms between producers are set by order. Where a farm is transferred along with its authorisations, the share of unused quota at the time of the transfer is allocated to the new holder.

Section III — Weighting factor

Art. LP.57 — The weighting factor is the coefficient (or set of coefficients) applied to determine an individual quota, based on the elements listed in Article LP.56. The definition, calculation method and the values of the coefficients are set by order of the Council of Ministers.

Compliance with production quotas is monitored by the department in charge of pearl culture under the conditions provided in Articles LP.58 and LP.59 of this Country Law.

Chapter II — Post‑production control and quality monitoring

Section I — Scope

Art. LP.58 — Post‑production control applies to cultured Tahitian pearls, Tahitian keshi, Tahitian blister cultured pearls (mabe) and mother‑of‑pearl products. Only products that have passed this control may be offered for sale.

Every producer of pearl products must present, at a minimum, samples representative of the items defined in Articles LP.2, LP.3, LP.4 and LP.5 of this Country Law.

Section II — Procedure and control

Art. LP.59 — During this control, cultured Tahitian pearls are presented according to the general criteria defined in Article LP.21 of this Country Law. Presentation is the responsibility of the producer or their representative. Items that do not meet the presentation conditions are returned to the depositor.

Without prejudice to the sanctions provided for in Chapters II and III of Title XII, products refused at control are not given an official record and may not be offered for sale.

Accepted lots of cultured pearls are weighed and registered; a receipt is issued and given back upon restitution of the pearls.

The department in charge of pearl culture may carry out checks on nacre thickness of lots presented at control.

After control, upon request, the lots may be sealed by the department.

TITLE VIII — TRADING IN PEARL PRODUCTS

Chapter I — Definition of trader in pearl products; eligibility; disabilities; prohibition on exercising; incompatibility

Section I — Definition of the activity

Art. LP.60 — A trader in pearl products is any natural or legal person who buys and resells pearl products that have passed post‑production control under Articles LP.58 and LP.59.

Section II — Eligibility

Art. LP.61 — Eligible for authorisation to exercise the activity of trader in pearl products is any natural person who is a European national or any legal person having their domicile or registered office in French Polynesia.

Section III — Disabilities

Art. LP.62 — No one may engage in or lend their assistance, even incidentally, to the operations referred to in Article LP.60 if they have been convicted of a criminal offence or any of the offences listed below: forgery and the use of forgeries (Penal Code, Title IV, Art. 441 et seq.); theft, receiving, fraud, breach of trust, bankruptcy, extortion; issuing cheques without funds and offences relating to usury, money‑lending and certain canvassing and advertising operations; misappropriations committed by public depositaries; corruption and extortion by public officials; perjury, false oaths and subornation of witnesses; offences under Article 13 of Law No. 52‑332 of 24 March 1952 relating to deferred‑credit companies.

Section IV — Prohibition on exercising

Art. LP.63 — The same prohibition on exercising the activity of trader in pearl products applies to persons subject to personal bankruptcy or the disqualifications provided for by the Commercial Code, to dismissed ministerial officers, to removed court‑appointed administrators and receivers, and to members definitively struck off for breaches of probity from professions organised as an order.

Section V — Incompatibility

Art. LP.64 — Any natural or legal person authorised to exercise the activity of trader in pearl products may not, under the same legal entity, exercise the activity of producer of pearl products.

Chapter II — Authorisation to exercise as a trader

Art. LP.65 — Any natural or legal person wishing to exercise the activity of trader in pearl products must obtain a trader card. The applicant must meet the following conditions: regular tax situation; regular situation with the Social Security Fund; proof of professional aptitude; financial guarantee (surety or insurance) covering funds and valuables entrusted in the course of trading; professional civil‑liability insurance; premises for storage and sale; and not being affected by the disabilities, prohibitions or incompatibilities set out in Articles LP.62 and following.

Art. LP.66 — Every trader in pearl products must maintain a register of purchases and sales of pearl products available at any time on their premises, and periodically provide the department in charge of pearl culture with the data necessary to monitor the sector; the content of the register, the data to be transmitted and their submission procedures are set by order of the Council of Ministers. The department may inspect stocks and supporting documents.

Chapter III — Retail jeweller and artisan retailer in pearl products

Section I — Definition; eligibility; disabilities; prohibition on exercising; incompatibility

Art. LP.67 — A retail jeweller in pearl products is any natural or legal person who sells to the end consumer finished jewels or articles containing pearl products that have passed post‑production control.

A pearl‑product artisan retailer is any natural or legal person who makes and sells, directly to the consumer, jewellery or articles produced by the artisan from pearl products that have passed post‑production control. [Partly truncated in the uploaded source.]

Art. LP.68 — Eligibility conditions for retail jewellers and artisan retailers are those set for traders in Article LP.61, mutatis mutandis. [Partly truncated in the uploaded source.]

Art. LP.69 — Authorisation to exercise the activity of retail jeweller or artisan retailer in pearl products is granted to eligible applicants having their domicile or registered office in French Polynesia.

Art. LP.70 — Disabilities (disqualifying offences) are the same as in Article LP.62 (forgery, theft and related offences, usury‑related offences, offences by public depositaries, perjury, etc.).

Art. LP.71 — The same prohibition on exercising the activity of retail jeweller or artisan retailer applies to persons subject to personal bankruptcy or the other disqualifications provided by the Commercial Code, to dismissed ministerial officers, to removed court‑appointed administrators and receivers, and to members definitively struck off for breaches of probity from professions organised as an order.

Art. LP.72 — Any natural or legal person authorised to exercise the activity of retail jeweller in pearl products may not, under the same legal entity, exercise the activity of artisan retailer in pearl products, and vice‑versa.

Art. LP.73 — A retail jeweller or an artisan retailer in pearl products must obtain the relevant professional card; conditions of issue, renewal and withdrawal are set by order. They must keep registers of purchases and sales and comply with the controls defined by this Country Law. [Condensed from the source to match the uploaded text.]

Chapter IV — Duty‑free enterprise

Section I — Definition of the activity

Art. LP.76 — Any legal person devoting its activity to exporting jewels or articles incorporating pearl products may apply for approval to qualify as a duty‑free enterprise.

A duty‑free enterprise must use pearl products that have passed post‑production control under Articles LP.58 and LP.59. It must use pearl products originating in French Polynesia and may use imported components placed under the customs regime of the industrial warehouse.

Section II — Eligibility

Art. LP.77 — Eligible for approval as a duty‑free enterprise is any legal person having its registered office in French Polynesia.

Section III — Disabilities

Art. LP.78 — No one may engage in, or lend assistance to, the operations referred to for duty‑free enterprises if convicted of a criminal offence or any of the following: forgery and use of forgeries in private commercial or banking instruments; theft, receiving, fraud, breach of trust, bankruptcy, extortion; issuing cheques without funds and offences relating to usury, money‑lending and certain canvassing or advertising operations; misappropriations by public depositaries; corruption and extortion by public officials; perjury, false oaths and subornation of witnesses; offences provided for in Article 13 of Law No. 52‑332 of 24 March 1952 relating to deferred‑credit companies.

Section IV — Prohibition on exercising

Art. LP.79 — The same prohibition on exercising the activity applies to persons subject to personal bankruptcy or the disqualifications provided by the Commercial Code, to dismissed ministerial officers, to removed court‑appointed administrators and receivers, and to members definitively struck off for breaches of probity from professions organised as an order.

Section V — Incompatibility

Art. LP.80 — Duty‑free enterprise status is granted upon application. The application is filed with the competent authority and must include information on the planned activity, premises and equipment, compliance with tax and social obligations, a financial guarantee (surety or insurance) where required, professional civil‑liability insurance, and identification of the legal representative. The approval is personal and non‑transferable; in the event of death or change of legal representative, the new representative must file a complete application within two months. [Condensed to reflect the uploaded text.]

Section VI — Effects of approval and exemptions

Art. LP.81 — Enterprises approved as duty‑free benefit, under conditions, from exemptions from duties and taxes for their export activity. [Heading continues “Exemption from duties and taxes” in the source.]

Art. LP.82 — Machines and tools needed for producing and setting jewels or articles incorporating pearl products may be imported under exemption, subject to the conditions set by regulation. The same exemption applies to raw materials and components imported for manufacturing these jewels or articles under the industrial‑warehouse customs regime. Documentary proof must be kept. [Condensed from the source.]

Art. LP.83 — Duty‑free enterprises are authorised to place imported goods under the customs regime of the industrial warehouse. They must comply with the obligations and controls inherent to that regime. [Section title in the source: “Exemption from duties and taxes / Industrial warehouse”.]

Art. LP.84 — The enterprise holding duty‑free status may receive goods under the industrial‑warehouse regime and carry out the processing listed in its approval; it is bound by the accounting and traceability obligations required by customs.

Art. LP.85 — Where machines or tools are released for home use (“mise à la consommation”), duties and taxes become payable under the conditions laid down by customs regulations.

Art. LP.86 — In the event of voluntary sale of machines, tools or materials imported under exemption, the applicable duties and taxes are owed; in the event of sale by forced execution, the price is allocated to duties and taxes after deduction of any pledgee’s claim.

Art. LP.87 — Every duty‑free enterprise must keep up‑to‑date registers available at all times for inspection by the competent administrations.

Section II — Customs control

Art. LP.88 — As part of the control of beneficiaries of the industrial‑warehouse regime, customs communicates any irregularities to the department in charge of pearl culture for the possible implementation of measures under this Country Law. [Condensed from the source.]

TITLE XI — EXPORT OF PEARL PRODUCTS

Chapter I — Export rules

Section I — Export of “raw” cultured pearls, <em>keshi</em>, Tahitian blister cultured pearls (<em>mabe</em>) and mother‑of‑pearl products; export of worked cultured pearls and articles containing cultured pearls

Art. LP.89 — Only the following are authorised to export: for raw cultured pearls, keshi, mabe and mother‑of‑pearl products — the card‑holding professionals (producers of pearl products and traders in pearl products) under this Country Law; for worked cultured pearls and jewellery/articles containing cultured pearls — the card‑holding professionals (traders, retail jewellers and artisan retailers) under this Law. Before any export, cultured pearls of Tahiti must have passed post‑production control and, where applicable, sealing, in accordance with Articles LP.58, LP.59 and LP.92.

Art. LP.90 — A jewellery or goldsmith’s article containing a cultured pearl may be exported only if the pearl has passed post‑production control and if the mounting complies with professional standards ensuring the integrity of the pearl and the article. [Condensed from the source.]

Art. LP.91 — Without prejudice to the sanctions provided later in this Law, the department in charge of pearl culture may seize or order the return of pearls or articles exported in breach of the rules; it may also suspend or withdraw the authorisations of the professionals concerned. [Condensed from the source; the article also references obligations of retail jewellers and artisan retailers.]

Art. LP.92 — Before any export, natural (fine) pearls, cultured pearls — whether raw or worked — and articles containing cultured pearls must undergo pre‑export control and, where applicable, be sealed; the procedures for control, sealing and documentation are set by order of the Council of Ministers.

TITLE XII — PEARL‑SECTOR TAXATION AT EXPORT

Art. LP.93 — There is hereby created, at tariff positions including HS headings for pearl articles, a specific duty on exported pearls (“droit spécifique sur les perles exportées”, DSPE).

Art. LP.94 — Exports of articles made of natural or cultured pearls are subject to the DSPE, with the exceptions and exemptions defined by regulation, notably for samples or items presented at exhibitions, fairs or to customers, not intended for commercialisation.

Art. LP.95 — For pearl products concerned, the triggering event for the DSPE is the exportation of goods outside the customs territory of French Polynesia, i.e., consignments to countries and territories outside that territory. The base, rate, collection methods and declaration obligations are set by order of the Council of Ministers.

Art. LP.96 — By way of derogation from the foregoing, certain exports may be exempt from the DSPE under the conditions set by order.

TITLE XIII — PEARL‑FARMING COUNCIL, DISCIPLINARY COMMISSION AND DECENTRALISED MANAGEMENT COMMITTEES

Chapter I — Pearl‑farming Council

Section I — Scope

Art. LP.97 — A Pearl‑farming Council is hereby established. It is consulted on the strategic orientations of the pearl industry, in particular with regard to production and marketing, quality policy, research and training, and the sustainable management of lagoon environments.

Section II — Composition

Art. LP.98 — The Council comprises representatives of public authorities, professional organisations and qualified experts. Its composition, appointment procedures and operating rules are set by order.

Chapter II — Disciplinary Commission

Section I — Scope

Art. LP.99 — A Disciplinary Commission is hereby established to examine breaches of this Country Law and to propose disciplinary measures with regard to professional cards and approvals issued under it.

Section II — Composition

Art. LP.100 — The Commission comprises members drawn from the administration, the professions and qualified persons. Its operating procedures, referral rules and decision‑making processes are defined by order. The next chapter establishes the Decentralised Management Committee.

Chapter III — Decentralised Management Committee

Art. LP.101 — At the request of the minister responsible for pearl culture, the mayor, or a collective of pearl farmers, a decentralised management committee may be set up for a given lagoon or area. It is a forum for consultation and dialogue between public and private stakeholders on issues relating to pearl‑farming activities carried out there.

Within its geographical area of competence, the management committee issues opinions on measures envisaged for pearl‑farming in the area concerned.

It is also responsible for informing the department in charge of pearl culture of any abnormal mortality of living marine resources.

An order adopted by the Council of Ministers specifies the remit, composition and operating rules of the decentralised management committees.

Members of the decentralised management committees are appointed by order of the President of French Polynesia for renewable two‑year terms. Their functions are unpaid.

TITLE XIV — MISCELLANEOUS PROVISIONS

Chapter I — Service for evaluating nacre thickness of cultured Tahitian pearls

Art. LP.102 — Upon request, the department in charge of pearl culture may carry out an evaluation of nacre thickness of cultured Tahitian pearls, either free of charge or for a fee, as defined below.

The evaluation is performed free of charge when requested by the administration, the courts or the police authorities. It may also be carried out free of charge at the request of the producer of pearl products who owns the lot to be evaluated, where the request concerns pearls from their own production and the department has launched an evaluation campaign.

Pearls must be presented in lots, previously cleaned and classified.

They are presented by size and by the shapes defined by order under Article LP.21; where applicable, the nacre‑thickness request may target a given shape only.

Lots that do not meet the presentation requirements are returned to the depositor for proper classification.

At the request of a holder of a card provided for in Articles LP.28, LP.36, LP.65, LP.73 or LP.76, the department may also carry out, for a fee, an evaluation of nacre thickness under specifications defined by the requester.

Art. LP.103 — Any natural or legal person wishing to offer nacre‑thickness evaluation services for cultured Tahitian pearls must obtain prior authorisation from the department in charge of pearl culture. This authorisation takes the form of an approval issued by the competent authority. The conditions for granting, refusing and withdrawing approval are set by order adopted by the Council of Ministers.

Chapter II — Import, production and marketing of products having the appearance of cultured pearls

Art. LP.104 — The import, production and marketing of products, in any materials whatsoever, that imitate the appearance of cultured pearls as defined in Articles LP.2, LP.3, LP.4 and LP.5 are prohibited.

Chapter III — Derogation from the principles

Art. LP.105 — The transport and export of cultured pearls and of jewellery and goldsmith’s articles that are part of the traveller’s personal belongings are authorised, subject to compliance with Articles LP.53, LP.89 and LP.90 of this Country Law.

Throughout French Polynesia, individuals may hold the above‑mentioned products in quantities that must not indicate any commercial intent.

This quantity, determined by number per natural person, is set by order adopted by the Council of Ministers.

Chapter IV — Fishing prohibition

Art. LP.106 — The harvesting of wild pearl oysters of the species Pinctada margaritifera var. cumingii fixed to a natural substrate is prohibited.

By derogation from the preceding paragraph, the department in charge of pearl culture may itself take, or authorise the taking of, samples as part of scientific research programmes and resource‑management programmes.

Chapter V — Confidentiality of data

Art. LP.107 — In accordance with Law No. 78‑17 of 6 January 1978 on information technology, files and freedoms, nominative data collected under this Country Law may be used only for the needs of the administration within the remit of the department in charge of pearl culture. They may be disclosed solely in the form of anonymised statistics.

Persons who have access to nominative data collected are bound by professional secrecy under the conditions laid down for the civil service of French Polynesia.

Such persons may use the data in the context of the controls provided for by this Law, and for establishing offences connected with this Law.

TITLE XV — SANCTIONS

Chapter I — Administrative‑sanctions procedure

Art. LP.108 — Without prejudice to any criminal proceedings that may be brought, the administrative‑sanctions procedure conducted by the department in charge of pearl culture is implemented as follows:

A — Formal notice to the person concerned to comply with the provisions of this Country Law within a period of fifteen (15) days from receipt of the formal‑notice letter;

B — Where the formal notice remains without effect, the person concerned is summoned to appear before a commission to present their case and submit written observations;

C — Where the breaches continue or the observations are insufficient, the decision to impose an administrative sanction is taken within one month of receipt of the formal notice referred to at A) above.

Chapter II — Administrative sanctions

Art. LP.109 — [Provision declared unlawful insofar as it applies to retail jewellers of pearl products and artisan retailers of pearl products.] Administrative sanctions are imposed in the following cases:

1) In the event of non‑compliance with the provisions of Articles LP.23 to LP.31, suspension or withdrawal of the authorisation to exercise as a nucleus dealer;

2) In the event of non‑compliance with Articles LP.32, LP.35, LP.37 to LP.43 and LP.50, suspension or withdrawal of the authorisation to exercise as a producer of pearl oysters and/or producer of pearl products, with loss of all inherent benefits;

3) In the event of non‑compliance with the provisions of Articles LP.60 to LP.66, suspension for six months of the authorisation to exercise as a trader in pearl products;

[The remainder of the article lists analogous measures for other categories; it is condensed here to reflect the uploaded source.]

Art. LP.110 — [Provision declared unlawful insofar as it applies to retail jewellers of pearl products and artisan retailers of pearl products.] Without prejudice to any criminal proceedings, an administrative fine may be imposed on:

— any person who fails to comply with the declaration obligations provided for by Articles LP.29, LP.50, LP.66, LP.75 and LP.87;

— any person who engages in, or lends assistance to, an activity subject to prior authorisation without holding such authorisation or without complying with its conditions;

— any producer of pearl products who exceeds the individual production quota provided for in Article LP.56;

— any nucleus dealer, producer of pearl products, trader, retail jeweller, artisan retailer or duty‑free enterprise who refuses to comply with a control or hinders it;

— any person who infringes the second paragraph of Article LP.23;

— any person who infringes the obligations provided for in Articles LP.58 to LP.60 concerning the prohibition on offering for sale, selling or exporting cultured pearls that have not passed control;

— [and other cases listed in the source.]

Chapter III — Criminal offences

Art. LP.111 — Subject to the approval (“homologation”) of this Country Law and without prejudice to the provisions of the Penal Code, the following constitute offences when established by any means:

— any person who engages in, or lends assistance to, an activity subject to prior authorisation without being the holder of the authorisation to exercise the activity concerned;

— any person who exercises, or attempts to exercise, activities referred to in this Law notwithstanding the disabilities, incompatibilities and prohibitions arising under it.

Art. LP.112 — The following is punishable by six months’ imprisonment and a fine of 1,500,000 CFP francs: obstructing controls carried out by the department in charge of pearl culture, or refusing to communicate documents, information or data necessary for applying this Law, by a holder of a card issued under Articles LP.36, LP.65, LP.73 or LP.80.

Chapter IV — Investigation and recording of offences

Art. LP.113 — Pursuant to Article 809 II of the Code of Criminal Procedure, the following are empowered to investigate and record offences against this Country Law:

1) officers of the department in charge of pearl culture;

2) officers of the department in charge of economic affairs and fraud control;

3) customs officers, in accordance with the provisions of the Customs Code;

4) judicial police officers and agents, acting under the provisions of the Code of Criminal Procedure.

During controls under this Law, the agents mentioned above may be assisted by a representative of the department in charge of pearl culture acting as an expert on pearl‑industry matters.

TITLE XVI — TRANSITIONAL PROVISIONS

Chapter I — Declaration of stocks of nuclei or pearl products held before promulgation of this Country Law

Art. LP.114 — Nucleus dealers holding, prior to the promulgation of this Country Law, stocks of nuclei or raw materials must declare them to the department in charge of pearl culture within the time limit set by order.

Producers and traders of pearl products holding, prior to promulgation, stocks of pearl products must declare them within the same time limit to the department in charge of pearl culture.

Retail jewellers and artisan retailers of pearl products holding, prior to promulgation, stocks of worked pearls or articles containing cultured pearls must declare them within the same time limit to the department in charge of pearl culture.

Duty‑free enterprises holding, prior to promulgation, stocks covered by their approval must declare them within the same time limit to the department in charge of pearl culture.

Art. LP.115 — Within three months from the date of promulgation of this Country Law, the authority issues to holders of valid authorisations the corresponding professional card, for the remaining period of validity of the authorisation concerned.

Chapter III — Bringing activities into compliance

Art. LP.116 — [Provision declared unlawful insofar as it applies to retail jewellers of pearl products and artisan retailers of pearl products.] Persons exercising an activity subject to prior authorisation without holding a valid authorisation on the date of promulgation of this Country Law must regularise their situation within three months by filing an application for authorisation for the activity concerned.

Failing such regularisation within the prescribed period, they incur the sanctions provided for in Chapters II and III of Title XV of this Country Law.

TITLE XVII — FINAL PROVISIONS

Art. LP.117 — The following texts are repealed:

— Deliberation No. 93‑61 AT of 11 June 1993, as amended, setting the methods for transfer of Pinctada margaritifera oysters in French Polynesia;

— Deliberation No. 93‑168 AT of 30 December 1993, as amended, amending pearl‑sector taxation at export;

— Deliberation No. 98‑63 APF of 11 June 1998, as amended, establishing the trader’s card for cultured Tahitian pearls;

— Deliberation No. 2002‑51 APF of 27 March 2002 regulating the activities of producer of pearl oysters and producer of cultured Tahitian pearls;

— Deliberation No. 2004‑29 APF of 12 February 2004 relating to planning, regulation and quality in the pearl sector in French Polynesia;

— Deliberation No. 2005‑42 APF of 4 February 2005 defining cultured Tahitian pearls, and jewellery and goldsmith’s articles containing them.

This act shall be executed as Country Law.

Done at Papeete, 18 July 2017.

Relating to the exercise of professional activities connected with pearl culture in French Polynesia

The full content of the law is structured by titles, chapters, sections and articles as published in the Official Journal of French Polynesia.

This document notably includes:

- Legal definitions of pearl products

- Conditions governing the professions of nucleus dealer, producer, trader, jeweller or artisan retailer

- Production quotas and reporting obligations

- Rules relating to export, sanctions and duty-free enterprises

Official text published in the Official Journal of French Polynesia on 18 July 2017.

COUNTRY LAW No. 2017-16 of 18 July 2017 regulating professional activities linked to the production and marketing of pearl and mother-of-pearl products in French Polynesia.

NOR: DRM1621306LP

After the opinion of the Economic, Social and Cultural Council of French Polynesia;

The Assembly of French Polynesia has adopted;

Having regard to the decision of the Council of State No. 407125 dated 28 June 2017;

The President of French Polynesia hereby promulgates the following Country Law:

TITLE I — PURPOSE

Article LP.1 — The purpose of this Country Law is to regulate the activities of nucleus dealers, producers of pearl oysters, producers, traders, jeweller-retailers, artisan-retailers and duty-free enterprises dealing in pearl products originating from the pearl oysters present in French Polynesia — notably Pinctada margaritifera var. cumingii and Pinctada maculata — as well as products of mother-of-pearl.

It lays down rules relating to the production, classification, transport, marketing and export of raw and worked pearl products, jewellery and articles containing them, as well as mother-of-pearl products of French Polynesia.

TITLE II — DEFINITIONS

Chapter I — Pearl products and mother-of-pearl products of French Polynesia

Section I — Pearl and mother-of-pearl products from the pearl oyster <em>Pinctada margaritifera</em> var. <em>cumingii</em>

Sub-section 1 — The natural (fine) Tahitian pearl

Art. LP.2 — The natural (fine) Tahitian pearl is a natural concretion secreted accidentally, without any human intervention, inside the pearl oyster Pinctada margaritifera var. cumingii present in French Polynesia. It is composed of concentric layers of nacre tablets deposited one upon another — a material formed of calcium carbonate (aragonite) associated with organic compounds — laid in thin layers separated by organic membranes.

Sub-section 2 — Cultured pearls

Paragraph I — The cultured Tahitian pearl

Art. LP.3 — The cultured Tahitian pearl is a pearl of natural colour, resulting from grafting and rearing in a natural environment in French Polynesia, and having undergone none of the treatments defined in Article LP.10 of this Country Law.

It is the raw product of the biomineralisation process of epithelial cells of a graft — a piece of mantle taken from a donor mollusc of the genus Pinctada, originating from French Polynesia — around a nucleus. This support, with specific characteristics, is inserted by humans into the pearl pocket (gonad) of the pearl oyster Pinctada margaritifera var. cumingii. It enables the graft to develop a pearl sac at the origin of the biomineralisation of the nacre layer.

The cultured Tahitian pearl is composed of numerous concentric nacre layers deposited one over another around the nucleus. These nacre layers, whose composition is substantially identical to that of the mother-of-pearl shell, are composed of conchiolin (around 6%) and aragonite crystals (around 92%), the remainder being various mineral salts and water.

An order adopted by the Council of Ministers defines the characteristics of the nuclei authorised for the production of cultured Tahitian pearls.

Paragraph II — Other cultured pearls

Art. LP.4 — Other cultured pearls are pearls that follow the biomineralisation process and composition defined in Article LP.3 of this Country Law, but which use a nucleus whose composition and/or shape differs from that authorised for the production of cultured Tahitian pearls, or a graft whose origin is other than a mollusc of the genus Pinctada.

Paragraph III — Tahitian keshi

Art. LP.5 — Tahitian keshi is a cultured pearl without a nucleus, of natural colour, formed entirely of nacre layers resulting from the biomineralisation process of the pearl sac formed from the epithelial cells of the graft — a piece of mantle taken from a donor mollusc originating from French Polynesia.

After human intervention, this graft is either introduced on its own into a recipient oyster of the species Pinctada margaritifera var. cumingii reared in French Polynesia, or introduced together with a nucleus which is subsequently expelled from the pearl pocket (gonad) or becomes separated from the graft following movement within the recipient oyster’s pearl pocket.

Paragraph IV — The Tahitian blister cultured pearl

Art. LP.6 — The Tahitian blister cultured pearl, commonly called a mabe, is the product made in French Polynesia resulting from:

— nacre secretion around a half-bead glued to the inner surface of the shell of a pearl oyster Pinctada margaritifera var. cumingii;

— and a manufacturing process comprising four successive stages:

- cutting the mother-of-pearl shell;

- removing the half-bead;

- filling with resin;

- permanently closing the concavity with a piece of polished Tahitian mother-of-pearl shell, or mounting as a finished item or jewellery article;

The second and third indents are optional.

The nacre deposits covering this half-bead have a lamellar arrangement identical to that of the deposits in the Tahitian mother-of-pearl shell defined in Article LP.7 of this Country Law.

Sub-section 3 — The Tahitian mother-of-pearl shell

Art. LP.7 — The Tahitian mother-of-pearl shell is the natural product of nacre secretion by the pearl oyster Pinctada margaritifera var. cumingii present in French Polynesia.

These nacre secretions, deposited in lamellar form, are subdivided into three layers:

- an outer organic layer, the periostracum, composed of conchiolin;

- an intermediate prismatic layer, the ostracum, composed essentially of calcite;

- an inner nacreous layer corresponding to tabular aragonite deposits.

Section II — Pearl and mother-of-pearl products from the pearl oyster <em>Pinctada maculata</em>

Sub-section 1 — The golden natural (fine) Tahitian pearl

Art. LP.8 — The golden natural (fine) Tahitian pearl, commonly called “poe pipi”, is a natural concretion secreted accidentally, without any human intervention, inside the pearl oyster Pinctada maculata present in French Polynesia. It is composed of concentric layers of nacre tablets deposited one upon another, formed essentially of calcium carbonate (aragonite) associated with organic compounds.

Sub-section 2 — The golden natural blister pearl of Tahiti

Art. LP.9 — A golden natural blister pearl of Tahiti is an excrescence accidentally secreted, without any human intervention, on the inner wall of the shell of the pearl oyster Pinctada maculata present in French Polynesia. This natural concretion is composed of concentric layers of nacre tablets deposited one upon another, formed essentially of calcium carbonate (aragonite) associated with organic compounds.

Section III — “Treated” natural and cultured pearls

Art. LP.10 — Natural pearls and cultured pearls produced in French Polynesia must be accompanied by the mention “treated” or by an indication of the treatment:

- when they have undergone artificial bleaching;

- when they have been treated by the deposition of any coating on the surface that irreversibly modifies their external appearance;

- when they have undergone “peeling”, a technique that removes nacre layers;

- when, as the case may be, they have undergone treatment by irradiation, laser, dye, surface diffusion, filling — possibly as a residue of heat treatment — of foreign colourless substances solidified in exterior cavities showing breaks in reflection visible under a 10× loupe, or by any other method modifying their appearance, colour or purity.

Chapter II — Definitions arising from the activity of pearl-oyster producers and producers of pearl products

Section I — Artificial fertilisation and spat collection

Sub-section 1 — Artificial fertilisation

Art. LP.11 — Artificial fertilisation is an operation consisting in producing planktonic larvae of the pearl oyster Pinctada margaritifera var. cumingii in a controlled environment. This operation is carried out in a hatchery and must comply with the regulations in force.

Sub-section 2 — Spat collection

Art. LP.12 — Spat collection is an operation consisting in promoting the settlement of planktonic larvae of the pearl oyster Pinctada margaritifera var. cumingii on supports artificially placed for this purpose. The “collector” is the support on which the larvae may settle.

Section II — Rearing and transfer

Sub-section 1 — The collection station

Art. LP.13 — A collection station is a set of collectors fixed on a mainline moored at a chosen location.

Sub-section 2 — Rearing Pinctada margaritifera var. cumingii pearl oysters

Art. LP.14 — The rearing of Pinctada margaritifera var. cumingii pearl oysters is an operation necessary for their development. It is accompanied by the care, maintenance and selections required for grafting.

Sub-section 3 — Rearing grafted Pinctada margaritifera var. cumingii pearl oysters

Art. LP.15 — The rearing of grafted Pinctada margaritifera var. cumingii pearl oysters is an operation necessary for their development, maintenance and the production of cultured Tahitian pearls.

Sub-section 4 — Transfer of Pinctada margaritifera var. cumingii pearl oysters

Art. LP.16 — The transfer of Pinctada margaritifera var. cumingii pearl oysters is an operation consisting in moving oysters from their place of production to another site for rearing or grafting. Inter-island transfers of pearl oysters must comply with the conditions laid down by the regulations in force.

Section III — Grafting, harvest and regrafting

Sub-section 1 — Grafting the pearl oyster Pinctada margaritifera var. cumingii

Art. LP.17 — Grafting the pearl oyster Pinctada margaritifera var. cumingii is the operation consisting in incising the tissues located above the pearl pocket and introducing the graft and the nucleus into the oyster’s pocket.

Sub-section 2 — Harvesting cultured Tahitian pearls

Art. LP.18 — Harvesting cultured Tahitian pearls is the operation consisting in extracting the pearls from the pearl pocket.

Sub-section 3 — Regrafting the pearl oyster Pinctada margaritifera var. cumingii

Art. LP.19 — Regrafting the pearl oyster Pinctada margaritifera var. cumingii is the operation consisting in introducing a new nucleus into the pearl sac after the extraction of the cultured pearl resulting from the first graft or a previous regraft.

TITLE III — CLASSIFICATION OF THE CULTURED TAHITIAN PEARL

Art. LP.20 — Every cultured Tahitian pearl is subject to classification criteria called general or additional criteria.

Chapter I — General criteria

Art. LP.21 — The general criteria are the size, weight, shape and surface quality of the pearl. These criteria are defined by an order adopted by the Council of Ministers.

Chapter II — Additional criteria

Art. LP.22 — The additional classification criteria include in particular colour, assortment, matching and the nacre thickness around the nucleus. These criteria are defined by an order adopted by the Council of Ministers.

TITLE IV — ACTIVITY OF NUCLEUS DEALER AND THE IMPORT OF NUCLEI

Chapter I — Activity of nucleus dealer

Section I — Definition of the nucleus dealer, eligibility, disabilities and incompatibilities

Sub-section 1 — Definition

Art. LP.23 — A nucleus dealer is any natural or legal person who manufactures, purchases, recycles or imports nuclei with a view to selling them.

They may sell nuclei only to a producer of pearl products holding a valid card, or to another nucleus dealer holding a valid card.

Sub-section 2 — Eligibility

Art. LP.24 — Eligible for authorisation to exercise the activity of nucleus dealer is any natural person who is a European national or any legal person having their domicile or registered office in French Polynesia.

Sub-section 3 — Disabilities

Art. LP.25 — No one may engage in or lend their assistance, even incidentally, to the operations referred to in Article LP.23 of this Country Law if they have been convicted of a criminal offence or of any of the offences listed below:

- forgery and use of forgeries in private commercial or banking instruments, forgeries defined in Chapter I, Title IV (Art. 441 et seq.) of the Penal Code;

- theft, receiving stolen goods, fraud, breach of trust, bankruptcy, extortion of funds, value or signature, offences punishable under the Penal Code;

- issuing cheques without funds and offences relating to usury, money-lending and certain canvassing and advertising operations;

- misappropriations committed by public depositaries, extortion by public officials, corruption of public officials and employees of private companies;

- perjury, false oaths and subornation of witnesses;

- offences provided for in Article 13 of Law No. 52-332 of 24 March 1952 relating to deferred credit companies.

Sub-section 4 — Prohibition on exercising

Art. LP.26 — The same prohibition on exercising the activity of nucleus dealer is incurred:

- by persons subject to personal bankruptcy or to any of the disqualification measures provided for by the provisions of the Commercial Code;

- by dismissed ministerial officers;

- by court-appointed administrators and receivers who have been removed;

- by members who have been disciplinarily and definitively struck off for breaches of probity from professions organised as an order.

Sub-section 5 — Incompatibility

Art. LP.27 — Any natural or legal person authorised to exercise the activity of nucleus dealer may not exercise the activity of pearl-oyster producer and producer of pearl products under the same legal entity.

Section II — Authorisation scheme for exercising the activity of nucleus dealer

Art. LP.28 — Any natural or legal person wishing to exercise the activity of nucleus dealer must first submit an application for authorisation to the department responsible for pearl culture. This authorisation takes the form of a nucleus dealer’s card.

The applicant must meet the following conditions:

A — Provide proof of premises for the storage and sale of nuclei in French Polynesia;

B — Provide proof of a regular tax situation with respect to the department in charge of taxes and public contributions;

C — Provide proof of a regular situation with the Social Security Fund;

D — Have taken out, with a company having a permanent establishment in French Polynesia, insurance covering the risks of professional civil liability incurred as a result of their act, fault or negligence, or that of their officers, agents, employees or volunteers;

E — Not be subject to any of the disabilities, prohibitions on exercising or incompatibilities defined in Articles LP.25, LP.26 and LP.27 of this Country Law. In order to verify that the applicant is not affected by these disabilities and prohibitions, the department in charge of pearl culture shall request bulletin No. 2 of the applicant’s criminal record from the competent authority.

These conditions are required for a legal person, with the exception of point E) of this Article, which shall be provided by the natural persons who have decision-making power.

As part of the examination of the application, the department in charge of pearl culture is empowered to carry out any useful investigations and to request from the applicant and the competent administrations any additional information or documents deemed necessary.

The nucleus dealer’s card is valid for five years but may be withdrawn at any time if the conditions under which it was issued are no longer met. It is renewable as long as the conditions that prevailed at the time of issue are still met.

For any renewal, the applicant must first be up to date with their reporting obligations, and the renewal application must be filed within three months before its expiry. On expiry of the authorisation, the holder loses the benefit of the card and must submit a new application.

The nucleus dealer’s card is personal and non-transferable and, in the case of a legal person, is issued to the legal representative, in that capacity.

In the event of death or change of legal representative, the legal person has a period of two months to file a complete file in the name of the new representative with the department in charge of pearl culture.

During this period and the time taken to process the file, the legal person may continue to carry on its activity.

An order adopted by the Council of Ministers lays down the procedures for examining the application for authorisation to exercise the activity of nucleus dealer and the conditions for granting, renewing and withdrawing it.

Section III — Reporting obligations